Individual Savings Accounts, universally known as ISAs, were introduced in 1999. Given their tax-free status, they have become a popular choice for savers and investors over the years. From relatively simple beginnings, there is now a wider range of ISA options available and we explore ways that individuals can make best use of their annual ISA allowance, and make existing ISAs work harder.

The primary reason for the ISAs popularity is the preferred tax treatment, which is enjoyed by all ISAs. Interest received on bond and cash investments held within an ISA is tax free and does not count towards your personal savings allowance. For Stocks and Shares investments, all capital gains and dividends are free of UK tax and dividends received within an ISA are ignored when considering your available dividend allowance.

Originally, there were only two types of ISA available. The Cash ISA, which is a simple deposit account offering either instant access or an interest rate for a fixed period of time, and a Stocks and Shares ISA, which allows investment in any share listed on a recognised stock exchange, together with Collective Investments, such as Unit Trusts.

Over the years, the list of available types of ISA has expanded, and with these changes, ISAs have become more complex. Junior ISAs were introduced in 2011, and are available to those aged under the age of 18. These ISAs can either hold Cash or Investments and automatically convert to adult ISAs when the child reaches the age of 18.

ISAs that aim to give individuals a helping hand onto the property ladder were introduced in 2015, via the Help to Buy ISA. This is now closed to new investors, being replaced with the Lifetime ISA. This ISA is open to individuals aged between 18 and 39, and allows investors to save towards a deposit on their first home, or to use the accumulated savings towards their retirement.

Whilst ISAs once had simple to understand investment limits for each Tax Year, with the varying types of ISA now available, careful consideration of the annual limits is now needed.

Irrespective of which ISA or ISAs are selected, the total contribution limit for adults across all ISAs in the 2021/22 Tax Year is £20,000. The Lifetime ISA annual limit is £4,000, although this forms part of the overall £20,000 limit that adults enjoy. The Junior ISA has an annual limit of £9,000, although by a quirk in the rules, children aged 16 or 17 can also subscribe £20,000 into a Cash ISA, in addition to the Junior ISA allowance.

One feature of traditional ISAs, which is not widely understood, is the ability to transfer an ISA from one provider to another, and also to transfer a Cash ISA to a Stocks and Shares ISA and vice versa. ISA transfers, which are carried out in a prescribed manner, retain the tax privileged status of the ISA, and do not interfere with the ability to make the full subscription in the current Tax Year. There are a number of caveats that need to be followed, including the need to comply with the overarching rule that an individual can only have one Cash ISA manager and one Stocks and Shares ISA manager in use at the same time, with money paid in from the current Tax Year.

The simplest form of ISA transfer is the ability to move Cash from one Bank or Building Society account to another deposit taker. Using the prescribed ISA transfer method, these transfers are straightforward and should take no more than 15 business days. The new account manager applies to the existing account to transfer the balance which arrives into the newly opened ISA.

Cash ISA transfers between banks and building societies can be useful to move funds to another bank offering a better rate of deposit interest. However, given the very poor rates of interest offered on savings accounts generally, and the increase in the rate of inflation over recent months, transferring between Cash ISA providers is likely to simply mean moving from one account offering negative real interest rates (i.e. after taking inflation into account) to another.

We are seeing an increase of clients in this position, and one potential solution is to consider transferring a Cash ISA to a Stocks and Shares ISA. This opens up a range of investment options within the ISA, from Equities (Shares), Corporate Bonds, Gilts and other Fixed Interest investments, to Commercial Property and Commodities, which aim to provide investors with superior returns to Cash in this period when interest rates remain low and inflation is rising quickly.

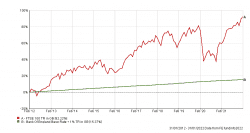

To demonstrate historic returns from assets other than cash, the chart below shows the return you would have received from Cash Savings (represented by the Bank of England Base Rate plus 1% per annum, with interest reinvested) compared to the total return achieved FTSE100 index of leading UK shares, over the last 10 years. Whilst obviously showing greater volatility, historic returns from Equities over the longer term have comfortably exceeded those achieved from holding funds on Cash deposit.

Important. Source : FE Analytics, January 2022. The graph shows the compound growth of the Base Rate plus 1% per annum with income reinvested, compared to the total return (growth in index value plus dividend income) from the FTSE100 index since January 2012. This graph is presented for illustrative purposes. Past performance of any investment is not necessarily a guide to future returns. The value of investments can go down as well as up and you may not receive a return of your original capital.

Any investment other than Cash will introduce an element of investment risk, and it is important to consider whether this is appropriate to your circumstances. This is where our experienced planners can help, by discussing the options with you and overseeing the ISA transfer process so that the valuable tax benefits are retained on transfer.

If you are interested in discussing the above with one of our experienced financial planners, please get in touch here.

The value of your investment and any income from it can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. The value of tax reliefs depends on your individual circumstances. Tax laws can change. The Financial Conduct Authority does not regulate tax advice.